Everything about Opening An Offshore Bank Account

Table of ContentsThe Main Principles Of Opening An Offshore Bank Account Little Known Facts About Opening An Offshore Bank Account.The Main Principles Of Opening An Offshore Bank Account Opening An Offshore Bank Account Things To Know Before You Get ThisOpening An Offshore Bank Account Can Be Fun For AnyoneIndicators on Opening An Offshore Bank Account You Need To Know

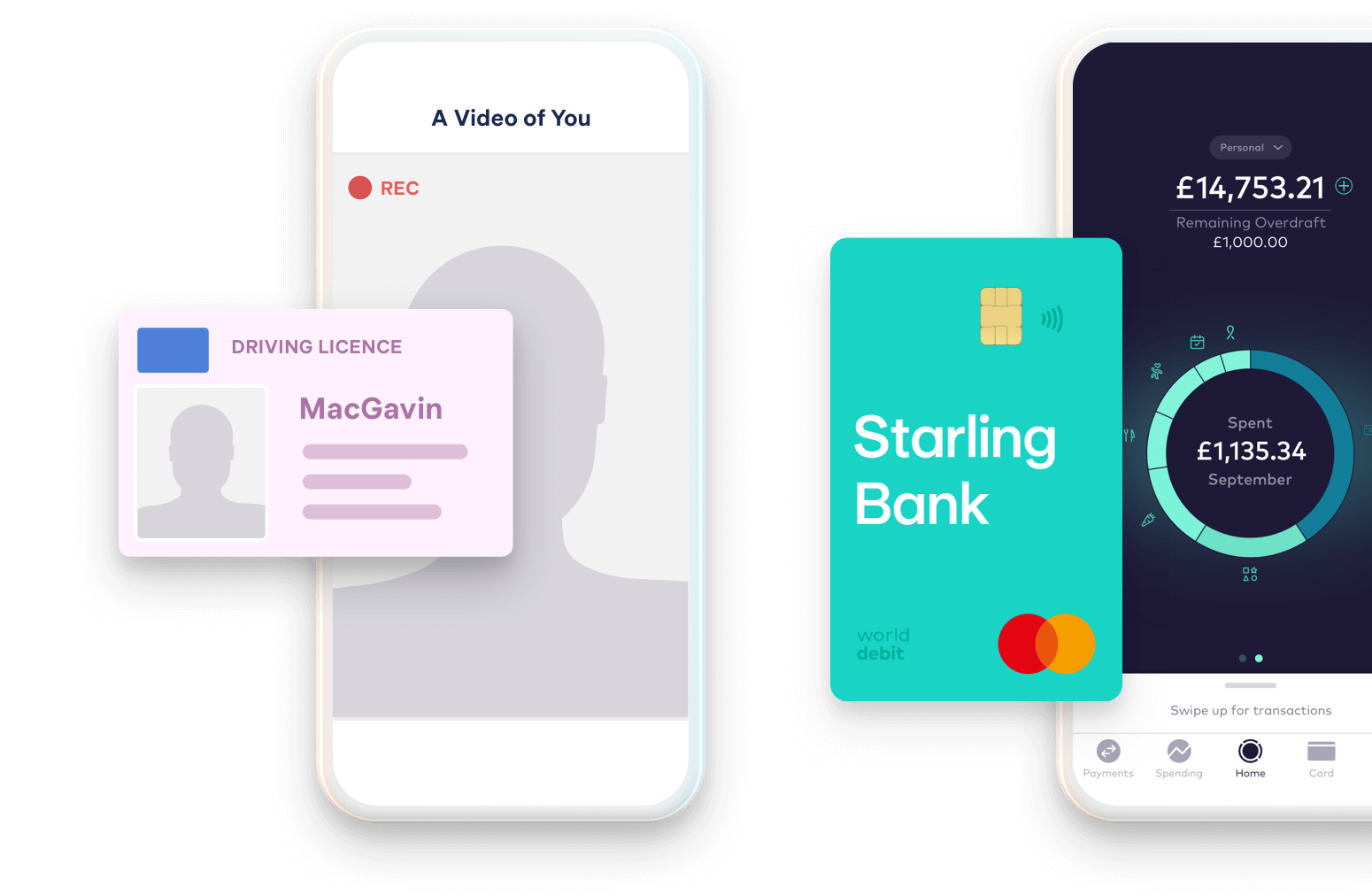

Whether you're assuming of relocating to the UK or you have actually gotten here there already, at some point you're mosting likely to require a savings account. In the past, opening up a checking account in the UK was extremely difficult if you were brand-new to the nation. Luckily, these days, it's ended up being slightly simpler (opening an offshore bank account).Once you've transformed your address, ask your bank to send out a bank statement to your new address by message, and you'll have a file that shows your UK address. If you do not have a proof of address in the UK as well as you require to open an account, Wise's multi-currency account might be the best selection for you.

Can I open a bank account prior to I arrive in the UK? Numerous major UK banks likewise have so-called. Opening a bank account from abroad or an international account may not be the best option for you.

You might not be able to close the account and switch to a much better bargain till a collection duration of time expires. The Wise multi-currency account.

Some banks are stringent with their demands, so opening a financial institution account with them will be hard. What is the simplest financial institution account to open in the UK?

4 Easy Facts About Opening An Offshore Bank Account Described

Barclays Barclays is one of the earliest financial institutions in the UK; and has more than 1500 branches around the country. It's also most likely one of the most convenient financial institutions to open up an account with if you're brand-new to the UK.

The account is totally free as well as comes with a contactless visa debit card as requirement. You won't be able to use your account instantly.

Barclays likewise uses a few different business accounts, depending on the annual turn over rate. You can connect with consumer assistance by means of a online conversation, where you can go over the details of your application and also ask concerns in genuine time. Lloyds Lloyds is the biggest supplier of current accounts in the UK, and has about 1100 branches throughout the nation.

Some Known Facts About Opening An Offshore Bank Account.

You can contact client assistance through a online chat, where you can talk about the information of your application as well as ask any kind of inquiries in actual time. Various other financial institutions worth checking out While Barclays, Lloyds, HSBC and also Nat, West are the four biggest financial institutions in the UK, there are also other financial institutions you can inspect.

Naturally, it's always best to consider what different banks need to offer as well as see that has the very best deal. Don't devote to an item without a minimum of look at this site taking a look at what else is available. What are the prices? You can obtain a fundamental bank account at no monthly cost from most high street banks.

Most banks also have premium accounts that use fringe benefits such as cashback on house costs, in-credit passion and insurance. However, these accounts will commonly have month-to-month charges as well as minimal eligibility requirements; and you may not certify if you're brand-new to the UK. You'll likewise need to be mindful to remain in credit history.

An Unbiased View of Opening An Offshore Bank Account

If you're not utilizing one of your financial institution's Atm machines, check the machine. Many banks will charge a, which can be as high as 2.

When you open this account, you'll have the option to take out an. A prepared overdraft permits you to borrow cash (up to a concurred limit) if there's no cash left in your account.

7 Easy Facts About Opening An Offshore Bank Account Described

However, we'll always try to enable vital payments if we can. You can apply for a prepared overdraft account when you open your account, or any time later on. You can ask to increase, eliminate or lower your limitation at any time in online or mobile banking, by phone or in-branch.

We report account activity, consisting of over-limit use, to credit report reference companies. An unarranged overdraft account lasting even more than 30 days can have a negative effect click to find out more on your credit scores ranking. This account comes with a. If you anonymous go overdrawn by more than that, you'll require to pay passion on the amount you borrow at the rate shown.